Professional Tax Registration in Dangs

Looking for a seamless Professional Tax Registration experience in Dangs? Well, you’ve come to the right place! Our local experts are here to provide you with swift and efficient service, ensuring that you receive your Professional Tax Certificate (PRC and PEC) in just 7 days. Moreover, according to Surat Municipal Corporation (SMC) rules, every business must register for Professional Tax within 60 days of starting operations. Consequently, in Dangs, businesses are required to pay Rs. 2400/- per year, while employees contribute Rs. 200/- per month. Therefore, to avoid any potential penalties, contact us today for a hassle-free, professional tax registration experience. By doing so, you can ensure your compliance with ease!

Looking for PT Registration Help in Dangs?

Looking for PT Registration Help in Dangs?

In Dangs District, The Gujarat State Tax on Profession, Trades, Callings, and Employment Act, 1976 governs Professional Tax. Consequently, every business, organization, and trade must register under this Act and obtain a Professional Tax Registration (PEC) for their business or branch in Dangs. Moreover, if your business employs staff, you must secure a Professional Tax (PRC) Certificate. You can conveniently obtain these registrations through the Dangs Municipal Corporation or the local Gram Panchayat, depending on your exact location within the district.

If you need assistance with Professional Tax (PEC and PRC) Registration in Dangs, our team is ready to provide fast and efficient services. Additionally, we will guide you through every step of the process. Contact us today, and let us help you ensure your compliance with the regulations!

Who Needs to Register for PT in Dangs?

To kickstart your business journey, it’s vital for all businesses, companies, organizations, and self-employed professionals engaged in commercial activities in the Dangs District to secure Professional Tax Registration from the Dangs Municipal Corporation or their local Gram Panchayat. Moreover, this requirement applies to every type of operation, including trading shops, showrooms, offices, warehouses, theaters, hospitals, associations, operators, doctors, professionals, agencies, lawyers, schools, and colleges. Furthermore, you must ensure compliance with this vital regulation, as it’s essential for smooth, hassle-free business operations and to avoid potential penalties. Consequently, take action now to ensure your business runs seamlessly and in full compliance with local regulations!

A Comprehensive Guide to Professional Tax Registration Types

In Dangs, the types of Professional Tax Registration Certificates available are:

- PEC – Professional Enrollment Certificate: Every company, establishment, or business is required to obtain a PEC (Professional Tax Enrollment Certificate) as the initial step. This certificate is crucial for ensuring compliance with local professional tax regulations. Therefore, it serves as the foundational requirement for businesses operating in the region. Moreover, securing this certificate enables businesses to align with local tax mandates effectively.

- PRC – Professional Registration Certificate: After acquiring the PEC, businesses with employees must also secure a PRC (Professional Tax Registration Certificate). This certificate is necessary to fulfill the professional tax obligations for your workforce. Consequently, businesses are required to obtain this additional certificate to ensure complete compliance with tax regulations. Furthermore, the PRC provides a formal acknowledgment of the business’s adherence to tax responsibilities, thereby avoiding any legal complications related to professional tax.

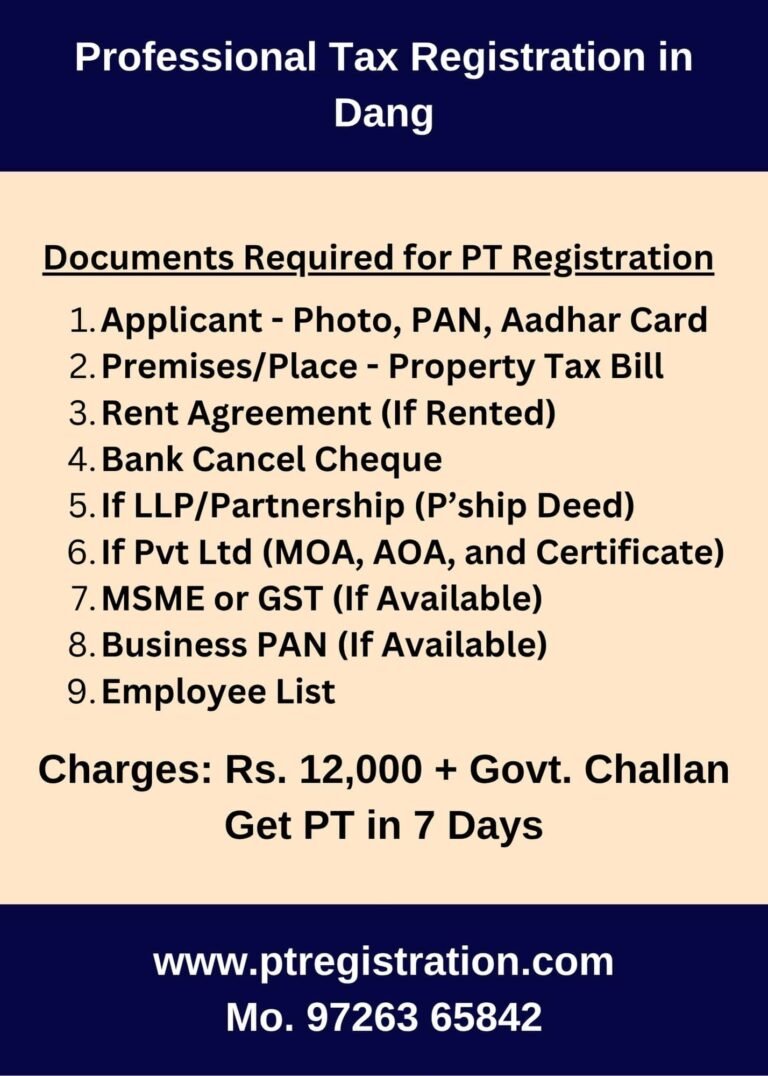

Essential Documents for PT Registration in Dangs

The following documents are needed for applying for Professional Tax Registration in Dangs.

- Photo of Applicant

- PAN Card of Applicant

- Aadhar Card of Applicant

- Mobile and Email

- Premises/Place – Property Tax Bill of Dangs

- Rent Agreement (If Rented)

- Business Document (Any One – MSME, GST, Business PAN Card, Registration Certificate etc)

- If Partnership Firm (Partnership Deed)

- If Private Limited Company (MOA, AOA, and Certificate of Incorporation)

- Business PAN Card (If Available)

- Bank Cancel Cheque Photo (Company or Applicant)

- Employee List with Joining Date (Deployed in Dangs)

- Office/Shop Photo with Board

Professional Tax Registration Advisory Costs in Dangs

As top consultants for Professional Tax Registration in Dangs, we offer the following service fees:

- Professional Fees: Rs. 12,000/- government challan extra as per rules.

- Additional Charge for Backdated Registrations: ₹250 per month from the start date

- Government Fees: ₹200 per employee per month, and ₹2,400 annually per company

- Shop Establishment Registration in Dangs: Available – Click here for details

Expert Tax Consulting Services in Dangs

- Fresh Registration: Starting a new business or job? Easily initiate your Professional Tax Registration in Dangs with our streamlined process.

- Update Requests: Need to update your details? We can assist with changes to your address, owner information, name, or other records in your Professional Tax profile.

- Cancellation or Surrender: If you need to end your Professional Tax registration, we offer hassle-free termination services for your Professional Tax Number in Dangs.

Whether you’re registering for the first time, updating your details, or canceling your registration, we provide comprehensive support for all your Professional Tax needs.

Professional Tax Rate Guidelines for Dangs

- Employer Contribution: Companies are mandated to pay an annual Professional Tax of ₹2,400. However, this amount may vary between ₹2,000 and ₹5,000, depending on the business location and nature. Consequently, businesses should be aware of these variations to ensure accurate tax payments.

- Employee Tax: For employees, ₹200 per month must be deducted from their salary and remitted to the relevant authorities. Nonetheless, if an employee’s salary is below ₹12,000, no Professional Tax is required. Therefore, it is crucial to assess each employee’s salary to determine the applicability of this tax.

These guidelines, therefore, help ensure compliance with Professional Tax regulations.

Completing PT Return Filings

- Deposit and File: First and foremost, it’s absolutely crucial to ensure that you deposit your Professional Tax (PRC) payments and file Form 5-A (PT Return) within 15 days after the end of each month. Furthermore, you must consistently pay ₹200 per employee each month promptly. Additionally, by doing so, you not only comply with regulations but also avoid any potential penalties. Moreover, this practice reinforces your commitment to maintaining financial discipline within your organization. Subsequently, this meticulous attention to detail significantly enhances your company’s credibility. Therefore, make it a priority to adhere to these guidelines without fail.

- Submit PEC Payment: Employers are required to complete their Professional Tax (PEC) payment by September 30th each financial year. Consequently, the payment amount, which varies from ₹2,000 to ₹5,000, depends on several factors. Specifically, these factors include the type of business, the number of employees, and the overall salary structure. Therefore, it is crucial for employers to review these factors thoroughly to ensure compliance and avoid any penalties.

Is Professional Tax Registration Required for Every Office/Branch in Dangs?

In Dangs, where each branch or office must, undoubtedly, obtain its own PEC (Professional Tax Registration) due to the decentralized system, it is absolutely essential to ensure that, if you operate multiple offices in the Dangs District/City, then you need to register each location separately, specifically within the jurisdiction of the respective Corporation or Village. Moreover, this approach, therefore, guarantees compliance, and, hence, facilitates smooth operations across all your business locations in the region.

Handling PT Registration for Dangs Municipal Corporations

Our Office : Dangs Field Officer for PT – Mr. Abhishek (Mo. +91 9726365842)

Dangs City – All Zones of Dangs City

Waghai – Waghai GIDC

Other Area and Vilalge: All Area and Villages of Dangs District – Ahwa, Waghai, Subir, Vapi etc.

FAQ's on Professional Tax in Dangs

Professional Tax is a state-imposed tax on individuals and businesses for conducting professional or trade activities. It applies to both employees and employers, with employers handling tax deductions and payments. Compliance is essential to avoid penalties and support local government revenues.

All individuals earning a salary, as well as businesses and employers operating in Dangs, are required to pay Professional Tax according to the applicable rates. Additionally, the tax obligations must be met timely to avoid penalties. Furthermore, businesses should ensure accurate calculation and payment of the tax. Moreover, any changes in employment status or business operations should be promptly reported to comply with the regulations.

To register for Professional Tax, businesses and employers need to obtain a Professional Tax Registration Certificate from the local Municipal Corporation or relevant authority in Dangs.

The rates for Professional Tax vary based on the category of the taxpayer (employer or employee) and their earnings. For specific rates, refer to the latest guidelines issued by the local authorities.