Professional Tax Consultant in Morbi

Are you seeking a Professional Tax Consultant in Morbi? Look no further! Our firm, conveniently located in Morbi, specializes in Professional Tax (PT) Registration services. Consequently, we ensure that your business swiftly obtains the Professional Tax Certificate (PRC and PEC) within just 7 days.

In line with the Morbi Municipal Corporation (MMC) guidelines, it is imperative for every business to secure Professional Tax Registration within 60 days of commencing operations. Furthermore, in Morbi, the Professional Tax rates are set at Rs. 2400/- per financial year for companies. Additionally, each employee incurs a Professional Tax of Rs. 200/- per month.

Therefore, if you need assistance with Professional Tax matters, do not hesitate to reach out to us for all your Professional Tax needs in Morbi. We are here to provide seamless solutions for your business requirements.

Expert Professional Tax Solutions in Morbi – Get Certified Fast!

Professional Tax (PT) Services for Businesses in Morbi

In Morbi District, Professional Tax rules are set by The Gujarat State Tax on Profession, Trades, Callings, and Employment Act, 1976. Businesses must register and obtain a Professional Tax Registration (PEC) for their operations. If you have employees, you also need a Professional Tax (PRC) Certificate.

You can get this registration from the Morbi Municipal Corporation or the local Gram Panchayat. If you need help with Professional Tax (PEC and PRC) Registration in Morbi, our team is ready to assist.

We simplify the registration process, ensure timely payments and filings, and handle monthly PT deductions for your employees. Let us manage your PT compliance so you can focus on your business. Contact us today!

Who Should Obtain Professional Tax Registration in Morbi?

Any business, company, organization, or self-employed professional operating in Morbi District is required to obtain Professional Tax Registration. Specifically, this registration must be acquired from either the Morbi Municipal Corporation (MMC) or the Gram Panchayat of the respective village in Morbi. Consequently, this requirement applies to a diverse range of business establishments. For instance, shops, showrooms, offices, warehouses, theaters, hospitals, associations, service providers, doctors, agencies, lawyers, schools, colleges, and many other entities must comply by registering for Professional Tax in Morbi.

Furthermore, it is essential for all relevant parties to ensure they meet this obligation. By doing so, they will avoid any potential compliance issues and adhere to regulatory standards. Moreover, ensuring timely registration and compliance helps maintain operational efficiency and prevents possible legal complications.

Thus, fulfilling this requirement not only aligns with legal obligations but also supports smooth business operations. Therefore, it is imperative to act promptly and correctly to meet these requirements and secure a hassle-free compliance process.

Different Professional Tax Registrations and Their Requirements

In Morbi, there are the following types of Professional Tax Registration Certificates that can be obtained:

Firstly, the Professional Enrollment Certificate (PEC) is required for every company, establishment, or business. Essentially, this registration is mandatory for all entities operating in Morbi.

Secondly, the Professional Registration Certificate (PRC) is necessary. Specifically, after obtaining the PEC Registration, if your company or business has employees on its payroll, then it is crucial to acquire the PRC Registration.

Therefore, obtaining both the PEC and PRC Certificates ensures comprehensive compliance with Professional Tax regulations in Morbi.

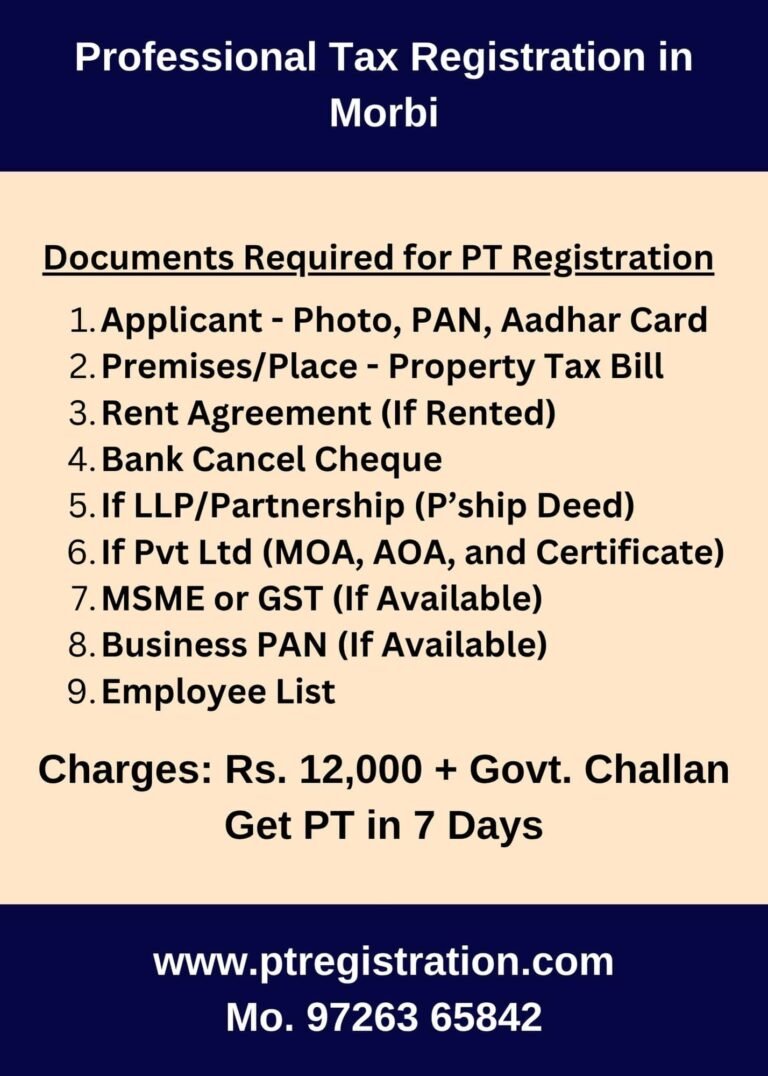

Documents Required for Professional Tax Registration in Morbi

To apply for Professional Tax Registration in Morbi, you need the following documents:

- Photo of Applicant – For identification purposes.

- PAN Card of Applicant – For tax and financial verification.

- Aadhar Card of Applicant – For identity and address proof.

- Mobile and Email – For communication.

- Premises – Property Tax Bill of Morbi – To verify the business location.

- Rent Agreement (If Rented) – If the premises are rented.

- Business Document (Any One) – Such as MSME Registration, GST Certificate, Business PAN Card, or Registration Certificate.

- If Partnership Firm – Partnership Deed.

- If Private Limited Company – Memorandum of Association (MOA), Articles of Association (AOA), and Certificate of Incorporation.

- Business PAN Card (If Available) – For additional verification.

- Bank Cancelled Cheque Photo (Company or Applicant) – For financial details.

- Employee List with Joining Date (Deployed in Morbi) – To confirm employees in Morbi.

- Office/Shop Photo with Board – To validate the business location.

Providing these documents will streamline your Professional Tax Registration process in Morbi.

Professional Tax Registration Consultancy Fees in Morbi

We are the best consultant for Professional Tax Registration in Morbi. To begin with, our professional fees are structured as follows:

Professional Fees: Rs. 12,000/- government challan extra as per rules

This fee covers all aspects of our consulting process. Additionally, if your registration is old-dated, an extra fee of Rs. 250 per month will apply from the beginning of the registration period.

Government Charges: Furthermore, the government charges include:

- Rs. 200/- per employee each month.

- Rs. 2400/- per year for the company.

By choosing our services, you not only ensure a smooth and efficient registration process but also gain clarity on the full cost structure. Thus, you benefit from our expert handling of your Professional Tax needs, making the process as seamless as possible.

PT Service Provide in Morbi

New Registration: For those seeking a new or fresh Professional Tax Registration in Morbi, we offer comprehensive assistance. Consequently, we ensure that your registration process is smooth and efficient, facilitating a hassle-free experience from start to finish.

Change Request: If you need to request changes—such as updating the address, owner, name, or other particulars related to your Professional Tax—we can seamlessly facilitate these modifications. Moreover, our services are designed to make the updating process straightforward and effortless.

Surrender or Cancellation of PT: Should you need to surrender or cancel your Professional Tax Number in Morbi, we handle the cancellation process effectively. In addition, we ensure that all procedures are correctly followed to complete the cancellation smoothly.

By choosing our services, you benefit from a streamlined approach to all your Professional Tax needs in Morbi. Thus, you gain peace of mind knowing that your Professional Tax matters are managed efficiently and professionally.

Rate of Professional Tax (Govt. Tax) in Morbi

Professional Employer Contribution (PEC): Employers, or companies, are obligated to pay Rs. 2400 per financial year as part of the Professional Employer Contribution. However, it is crucial to understand that this PEC tax can vary. Specifically, factors such as location and the nature of the business play a significant role. Consequently, the PEC tax may range from Rs. 2000 to Rs. 5000 per year, depending on these variables.

Professional Tax (PT) on Employees: On the other hand, employers must deduct Rs. 200 per employee each month from their salary and then remit this amount to the respective authority. Furthermore, it is important to note that if an employee’s salary is below Rs. 12,000, the Professional Tax does not apply, resulting in a zero amount.

Therefore, by carefully following these guidelines, businesses can effectively manage their Professional Tax obligations. As a result, they ensure full compliance with the regulations and avoid potential issues.

Thus, adhering to these requirements not only supports regulatory compliance but also contributes to smooth business operations and avoids any complications with tax authorities.

Filing of PT Return (Payment of Professional Tax)

Professional Tax (PRC) Payment: Employers must deposit the Professional Tax and file Form 5-A (PT Return) within 15 days after the end of each month. Specifically, this involves paying Rs. 200 per employee each month. Therefore, timely submission is crucial to ensure compliance and avoid any penalties.

Professional Tax Employer (PEC) Payment: In addition, you must pay the Professional Tax Employer Contribution before September 30 of each financial year. This amount varies, ranging from Rs. 2000 to Rs. 5000, based on factors such as the location and nature of your business. Consequently, making this payment on time is essential for fulfilling your annual tax obligations.

By adhering to these deadlines and payment requirements, you will effectively manage your Professional Tax responsibilities and maintain compliance with all regulations. Thus, timely action will help you avoid issues and ensure smooth operations throughout the year.

Is Separate Professional Tax Registration Required for Each Office in Morbi?

In Morbi, the Professional Tax Registration system operates in a decentralized manner. As a result, each branch or office must obtain its own Professional Tax Registration Certificate (PEC). If your business runs multiple offices within the Morbi District or City, secure a separate registration for each branch. Each office must register with the relevant authority, whether it is the Morbi Municipal Corporation or a local village panchayat.

By ensuring that every office complies with its specific registration requirements, you maintain regulatory compliance and prevent potential issues with tax authorities.

PT Registration: Offices Covered by Morbi Municipal Corporation

Our Office : Morbi Field Officer for PT – Mr. Abhishek (Mo. +91 9726365842)

Morbi City – All Zones of Morbi City

Dhuva– Dhuva GIDC

Other Area and Village: All Area and Villages of Morbi District –Vaghpar,Lalpar ,Nava Jambudiya, Sartanpar etc.

Frequently Asked Questions About Professional Tax in Morbi

A tax on professions, trades, and employment within Morbi District.

All businesses, companies, and self-employed professionals in Morbi.

Yes, each branch may require its own registration.

Yes, professional services are available to assist with registration and compliance.