Professional Tax Consultant in Bhavnagar

Are you seeking expert assistance for Professional Tax Registration in Bhavnagar? As a Professional Tax Consultant in Bhavnagar, we efficiently secure your Professional Tax Certificate (PRC and PEC) within just 5 days. According to the Bhavnagar Municipal Corporation (BMC) regulations, every business must obtain Professional Tax Registration within 60 days of commencement. Consequently, you will face an annual charge of Rs. 2400/- for companies and Rs. 200/- per month per employee.

By obtaining your Professional Tax Registration promptly, you ensure compliance with local regulations and avoid potential penalties or legal issues. Furthermore, this proactive approach simplifies the registration process and demonstrates your commitment to meeting regulatory requirements. Moreover, it facilitates smooth business operations and enhances overall operational efficiency. Additionally, securing the Professional Tax Certificate within the stipulated timeframe supports your business’s continued success.

For all your Professional Tax needs in Bhavnagar, connect with us today. We will streamline the process and provide expert guidance to help you meet all regulatory obligations seamlessly.

In Need of a Professional Tax Consultant in Bhavnagar?

Professional Tax (PT) Solutions for Businesses in Bhavnagar

In Bhavnagar District, The Gujarat State Tax on Profession, Trades, Callings, and Employment Act, 1976 regulates Professional Tax. This Act requires every business, organization, or trade to register under its provisions and obtain a Professional Tax Registration (PEC) for their business or branch in Bhavnagar. Additionally, businesses with employees must secure a Professional Tax (PRC) Certificate. Consequently, you can complete the necessary registrations through the Bhavnagar Municipal Corporation or the local authority based on your business’s location within the district.

Securing these registrations fulfills your legal obligations and ensures compliance with local regulations. Moreover, obtaining the appropriate PEC and PRC certificates helps you avoid potential penalties and legal issues. By getting these registrations, you demonstrate your commitment to adhering to regulatory standards, which fosters trust and credibility within the community.

If you need a Professional Tax Registration Consultant in Bhavnagar, our team is ready to assist you with prompt and efficient service for obtaining your PEC and PRC. Working with us ensures that all registrations meet regulatory requirements, streamlining your compliance process. Additionally, our expertise allows us to handle the details efficiently so you can focus on running your business smoothly. For a seamless and hassle-free experience in securing your Professional Tax Registration, contact us today.

Who Should Obtain Professional Tax Registration in Bhavnagar?

Any enterprise, whether a business, company, organization, or self-employed professional operating commercially within the geographic bounds of Bhavnagar District, must secure Professional Tax Registration from the Bhavnagar Municipal Corporation or the appropriate Gram Panchayat of the respective village. This registration ensures compliance with local tax regulations and helps you avoid potential penalties for non-compliance.

Therefore, you must obtain the necessary registration promptly if you engage in commercial activities. By doing so, you adhere to legal requirements and facilitate smooth business operations. Furthermore, timely registration helps you avoid any disruptions or legal issues arising from non-compliance. Additionally, securing Professional Tax Registration demonstrates your commitment to regulatory standards, which fosters trust and credibility within the community.

Moreover, obtaining this registration is not just a legal formality; it plays a crucial role in maintaining operational efficiency and safeguarding your business against potential fines. Consequently, timely registration helps you avoid the inconvenience of facing penalties and legal challenges in the future. Furthermore, our expert assistance ensures that we handle your registration process with precision, allowing you to focus on your core business activities without any administrative hassles.

Types of Professional Tax Registration and Their Obligations

In Bhavnagar, two key types of Professional Tax Registration Certificates are essential:

- PEC – Professional Enrollment Certificate: This certificate is a mandatory requirement for all companies, establishments, and businesses in Bhavnagar, ensuring they are duly registered under the Professional Tax laws.

- PRC – Professional Registration Certificate: After obtaining the PEC, any business or company with employees on its payroll must acquire the PRC to meet further tax compliance requirements.

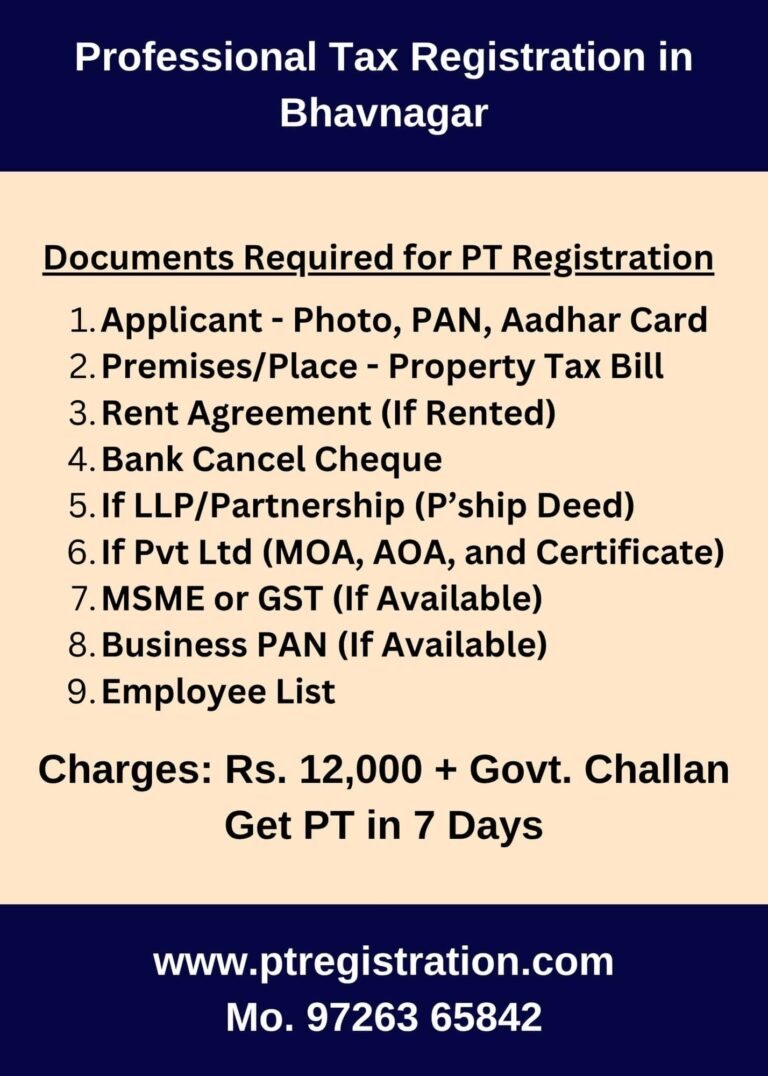

Professional Tax Registration: Required Documents in Bhavnagar

To apply for Professional Tax Registration in Bhavnagar, you will need the following documents:

- Recent Photo of the Applicant

- Applicant’s PAN Card

- Aadhaar Card of the Applicant

- Contact Information (Mobile Number and Email Address)

- Property Tax Bill of Bhavnagar for the Premises

- Rent Agreement (if the property is rented)

- Business Documentation (such as MSME registration, GST certificate, Business PAN Card, or any valid Registration Certificate)

- Partnership Deed (for Partnership Firms)

- MOA, AOA, and Incorporation Certificate (for Private Limited Companies)

- Business PAN Card (if available)

- Cancelled Cheque (from the company or applicant)

- Employee List with Joining Dates (for those stationed in Bhavnagar)

Photo of the Office/Shop Exterior with Signage

Professional Tax Consultancy Fees for Registration in Bhavnagar

We are the leading consultants for Professional Tax Registration in Bhavnagar, offering our expert services at competitive rates:

- Professional Fees: Rs. 12,000/- government challan extra as per rules.

- Additional Charges: For backdated registrations, an additional Rs. 250 per month from the commencement date will apply.

- Government Fees: Rs. 200 per employee per month, and Rs. 2400 annually for the company.

- In addition to Professional Tax Registration, we also offer Shop Establishment Registration in Bhavnagar—click here to learn more.

Our Professional Tax Consulting Services in Bhavnagar

New Registration: Initiate a fresh Professional Tax Registration in Bhavnagar.

Amendments: Update address, ownership, name, or other details in your Professional Tax records.

Surrender or Cancellation: Discontinue or cancel your Professional Tax Number in Bhavnagar.

Professional Tax Rate (Govt. Tax) Structure in Bhavnagar

- Employer PEC Obligations: Businesses must contribute Rs. 2400 annually per financial year. However, based on the business’s location and nature, this amount may range from Rs. 2000 to Rs. 5000 annually.

- Employee PEC Deductions: Employers are required to deduct Rs. 200 per month from each employee’s salary and remit it to the relevant authority. (Employees earning below Rs. 12,000 per month are exempt from Professional Tax).

Filing of PT Return (Remittance of Professional Tax)

- Employee Professional Tax (PRC) Payment: The PRC payment must be deposited and Form 5-A (PT Return) filed within 15 days after each month ends, with Rs. 200 due per employee monthly. Timely payment and filing are essential to avoid penalties and ensure compliance. For assistance, contact us to handle these requirements efficiently.

- Employer Professional Tax (PEC) Payment: The PEC payment must be made by September 30th of each financial year. The amount ranges from Rs. 2000 to Rs. 5000, depending on specific business factors. Therefore, timely payment is crucial to meet compliance requirements and avoid potential penalties. Additionally, ensuring you pay the correct amount helps maintain regulatory adherence and supports smooth business operations. For any assistance with this process, feel free to contact us.

With multiple offices/branches in Bhavnagar, do we need separate Professional Tax Registration for each one?

Therefore, it is essential to manage each registration separately to ensure compliance with local regulations. By doing so, you not only adhere to legal requirements but also streamline the administrative process for each office. Furthermore, this approach helps to avoid potential complications that might arise from having incomplete or incorrect registrations. Additionally, maintaining separate registrations for each location allows you to address any issues specific to that office efficiently.

Moreover, handling registrations individually ensures that each branch or office meets the specific requirements of its jurisdiction, thereby reducing the risk of administrative errors or oversights. Consequently, this meticulous approach facilitates smoother operations and better regulatory adherence. Furthermore, it supports better record-keeping and compliance management across all your business locations.

In addition, having separate registrations for each office helps in managing any jurisdiction-specific issues more effectively. As a result, you can address and resolve issues promptly, ensuring that your business operations remain uninterrupted.

Areas Covered for Professional Tax Registration with Bhavnagar Municipal Corporation

Our Office: Bhavnagar Field Officer for Professional Tax – Mr. Abhishek (Mobile: +91 9726365842)

Bhavnagar City – Comprehensive services throughout Bhavnagar

Chitra – Chitra GIDC.

Other Areas and Villages: Serving all areas and villages within Bhavnagar District, including Sihor, Talaja, Mahuva, and Palitana.

Professional Tax FAQs for Bhavnagar

A business address is essential for acquiring Professional Tax Registration in Gujarat, including Bhavnagar. This address may be residential (with appropriate consent) or commercial, and can be either owned or leased. Therefore, a designated office, shop, house, or similar premises is required for the Professional Tax application process in Gujarat. Consequently, having a valid address ensures that your application is processed correctly and in compliance with local regulations.

Yes, you can use a rented property as your address for Professional Tax Registration in Bhavnagar. However, you must ensure that you have the appropriate consent from the property owner. Consequently, providing a valid rental agreement or lease document will be essential for the registration process. By doing so, you confirm that your business address meets the regulatory requirements and supports a smooth application.

Regardless of having just one employee, Professional Tax Registration is mandatory. Therefore, if you have employees, you need to acquire Professional Tax (PRC) Registration. On the other hand, even if your company has no employees, Professional Tax (PEC) Registration is still required. Consequently, obtaining the appropriate registration ensures compliance with local regulations and avoids potential penalties.

Professional Tax Registration is required for all villages and rural areas. Thus, this registration must be processed through the Tehsildar (Talati) of the Bhavnagar District Gram Panchayat. Consequently, ensuring proper registration through the correct local authority helps maintain compliance with regulations.