Professional Tax Registration in Palanpur

Are you looking for Professional Tax Registration? We are experienced Professional Tax (PT) Registration Consultants, ready to assist you. Obtain your Company/Business Professional Tax Certificate (PRC and PEC) in just 5 days. According to municipal regulations, every business must obtain Professional Tax Registration within 60 days of starting operations. Consequently, businesses need to pay Rs. 2400/- per financial year for Professional Tax. Additionally, companies should pay Rs. 200/- per month per employee. Contact us today for all your Professional Tax requirements. We are here to help you every step of the way.

Searching for a Professional Tax Consultant in Palanpur?

Business Professional Tax (PT) in Palanpur

Professional Tax Rules are governed by The Gujarat State Tax on Profession, Trades, Callings, and Employment Act, 1976. Consequently, this Act requires every business, organization, and trade to register under the Act and obtain Professional Tax Registration (PEC) for their business or branch. Moreover, if a company employs staff, it must obtain a Professional Tax (PRC) Certificate. You can complete this registration process through the Municipal Corporation or the local Gram Panchayat, depending on the specific location within the district.

If you need assistance with Professional Tax (PEC and PRC) Registration, our team is ready to help. Connect with us today for prompt and efficient service in obtaining your Professional Tax Registration.

Who is Required to Register for Professional Tax in Palanpur?

Every business, company, organization, or self-employed professional operating within Palanpur District must obtain Professional Tax Registration. To begin with, you can complete this process either through the Palanpur Municipal Corporation or the appropriate Gram Panchayat, depending on your specific location within the district. Consequently, it is essential that all types of business establishments—including trading shops, showrooms, offices, warehouses, theaters, hospitals, associations, operators, doctors, professionals, agencies, lawyers, schools, and colleges—secure Professional Tax Registration in Palanpur. Moreover, this registration ensures compliance with local tax regulations and maintains operational legitimacy. Thus, adhering to this requirement supports the overall regulatory framework in the district.

Different Types of Professional Tax Registration and Their Requirements

PEC – Every company, establishment, or business must secure a PEC (PT) Registration to comply with industry standards and regulations. This registration is crucial for maintaining operational legitimacy and fulfilling legal obligations. It also helps build trust and credibility in your business. Additionally, it ensures adherence to necessary protocols and smooth navigation of regulatory requirements. Therefore, every entity should prioritize and complete the PEC (PT) Registration process promptly.

PRC – Professional Registration Certificate: After you obtain the PEC Registration, you must proceed with obtaining the PRC Registration if your company or business employs staff. This step is mandatory to ensure compliance with the regulations. By securing the PRC Registration, your business aligns with legal requirements, thus avoiding potential issues. Additionally, this registration helps maintain organizational standards and shows your commitment to regulatory adherence. Therefore, follow this procedure diligently to uphold operational integrity.

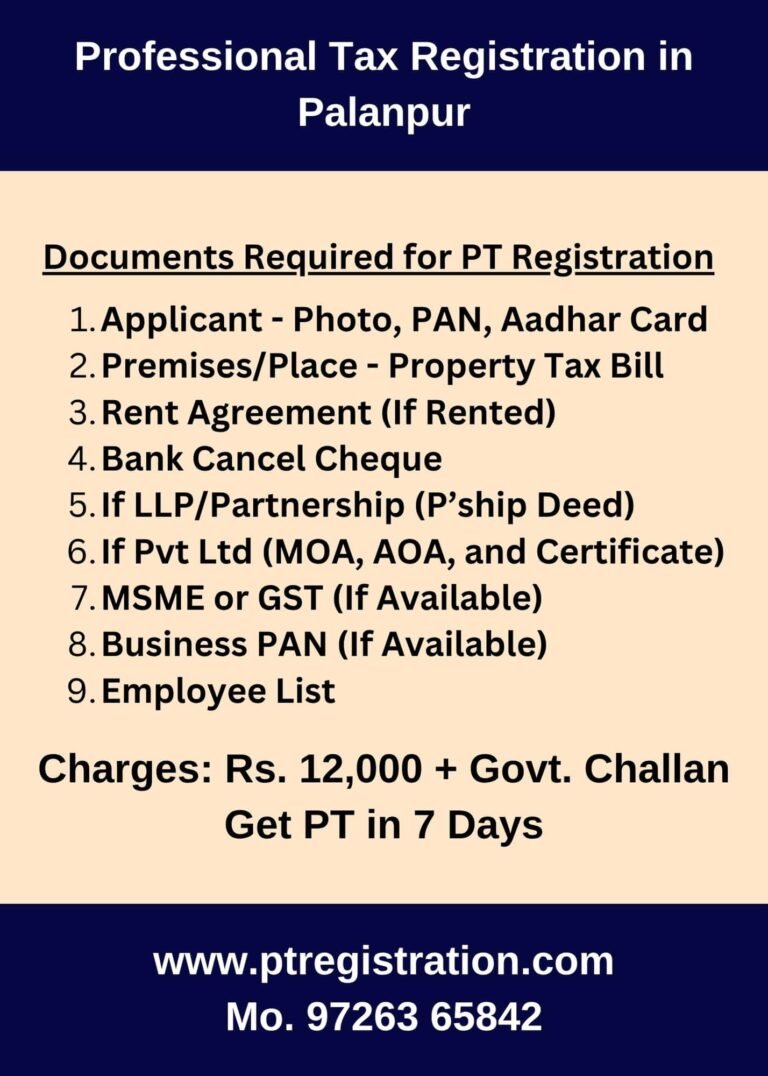

List of Documents for Professional Tax Registration in Palanpur

Following Documents are Required for Professional Tax Registration Application in Palanpur:

- Photo of Applicant

- PAN Card of Applicant

- Aadhar Card of Applicant

- Mobile Number and Email

- Premises/Place – Property Tax Bill of Palanpur

- Rent Agreement (If Rented)

- Business Document (Any One – MSME, GST, Business PAN Card, Registration Certificate, etc.)

- If Partnership Firm (Partnership Deed)

- If Private Limited Company (MOA, AOA, and Certificate of Incorporation)

- Business PAN Card (If Available)

- Bank Cancelled Cheque Photo (Company or Applicant)

- Employee List with Joining Date (Deployed in Palanpur)

- Office/Shop Photo with Signboard

Cost of Professional Tax Registration Consultancy in Palanpur

We are the Best Consultant for Professional Tax Registration in Palanpur. Our Professional Fees are as follows:

- Professional Fees: Rs. 12,000/- government challan extra as per rules.

- If Registration is Backdated, Then Rs. 250 Per Month from the Start Date (Additional)

- Government Charges: Rs. 200/- Per Employee Per Month, AND Rs. 2400 Per Year for the Company

- We Also Provide Shop Establishment Registration in Palanpur – Check Here

What We Provide as Professional Tax Consultant in Palanpur

- New Registration: Obtain a Fresh Professional Tax Registration in Palanpur

- Modification Request: Update Address, Ownership, Name, or Other Professional Tax Details

- Surrender or Cancel PT: Discontinue Your Professional Tax Number in Palanpur

Applicable Professional Tax (Govt. Tax) Rate in Palanpur

- PEC: Employers (Companies) must pay Rs. 2400 per financial year. However, depending on the location and nature of the business, the tax on the PEC can vary. Specifically, it can range between Rs. 2000 and Rs. 5000 per year. Consequently, these factors will influence the exact amount.

- PEC: Firstly, you must understand that you need to deduct a tax amount of Rs. 200 per employee per month from their salary and then pay it to the respective authority. However, if an employee’s salary is less than Rs. 12,000, the Professional Tax amounts to zero. Consequently, you must ensure that you make this deduction correctly in all applicable cases. Furthermore, this system ensures that you comply with the regulations and avoid any penalties. Moreover, it simplifies the process of collecting and paying taxes, thereby streamlining administrative tasks.

Filing of PT Return (Payment of Professional Tax)

- Firstly, the Professional Tax (PRC) payment must be deposited. Subsequently, Form 5-A (PT Return) must be filed within 15 days after the end of each month. Specifically, the amount to be deposited is Rs. 200 per employee per month. Therefore, it is essential to ensure timely deposit and filing to maintain compliance. Additionally, adhering to these requirements helps streamline the process and avoids potential issues.

- Professional Tax Employer (PEC) Payment is required to be paid before 30th September of each financial year. (Amount ranges from Rs. 2000 to 5000 depending on various factors)

Is Professional Tax Registration needed for every branch I have in Palanpur?

In Palanpur, the system for Professional Tax Registration operates on a decentralized basis. Consequently, each branch or office must obtain its own PEC (Professional Tax Registration). Therefore, if you manage multiple offices within the Palanpur District or City, it is crucial to secure separate registrations for each branch. This applies irrespective of whether your branches fall under the jurisdiction of the Municipal Corporation or a local village authority.

In other words, each office must independently navigate its registration requirements, ensuring compliance with the specific regulations applicable to its location. Hence, managing multiple registrations is essential for adhering to local tax obligations effectively.

PT Registration Assistance for Palanpur Municipal Corporation Offices

Our Office : Palanpur Field Officer for PT – Mr. Abhishek (Mo. +91 9726365842)

Palanpur City – All Zones of Palanpur City

Other Area and Vilalge: All Area and Villages of Palanpur District – Chhapi, Deesa, Radhanpur, Sidhpur, etc.

FAQ's on Professional Tax in Palanpur

In Palanpur, all employers, businesses, and self-employed individuals must pay Professional Tax. Employees earning above a certain threshold also need tax deducted from their salary by their employer. This ensures compliance with local tax regulations and maintains fairness in tax collection. Employers and employees must be aware of these obligations to avoid penalties. Adhering to these requirements supports local governance and public services.

The Professional Tax in Palanpur typically amounts to Rs. 2400 per year for employers. Additionally, for employees, the tax is Rs. 200 per month if their salary exceeds Rs. 12,000. Consequently, it’s important to note that the exact amount may vary based on the nature and location of the business.

Employers must, therefore, pay the Professional Tax (PEC) by 30th September each financial year. Simultaneously, employees should also deposit the Professional Tax (PRC). Additionally, you must file Form 5-A within 15 days of each month’s end. Consequently, adhering to these deadlines is crucial for ensuring compliance. Furthermore, timely payment and filing help maintain proper records and avoid any penalties. Thus, following these requirements diligently supports overall tax compliance and smooth administrative operations.