Professional Tax Registration Consultant in Jamnagar

Need Professional Tax Registration in Jamnagar? Look no further! We are your trusted local consultants, specializing in securing your Company or Business Professional Tax Certificate (PRC and PEC) within just 5 days. According to Jamnagar Municipal Corporation (JMC) regulations, businesses must complete Professional Tax Registration within 60 days of starting operations. Therefore, timely registration is crucial to meet local requirements. With tax rates set at Rs. 2400 per year for companies and Rs. 200 per month per employee, prompt registration ensures compliance, avoiding penalties and legal issues. Our expert team streamlines the process, handling all paperwork efficiently so you can focus on running your business without administrative hassles. For all your Professional Tax needs in Jamnagar, contact us today to ensure smooth, legal business operations.

Professional Tax Consultant in Jamnagar?

Professional Tax Registration for Businesses in Jamnagar

In Jamnagar District, adhering to Professional Tax regulations is crucial, as mandated by The Gujarat State Tax on Profession, Trades, Callings, and Employment Act, 1976. Every business, organization, or trade must register and obtain a Professional Tax Registration Certificate (PEC), while businesses with employees are also required to secure a Professional Tax Certificate (PRC). To ensure compliance, businesses must submit the necessary applications and documents to either the Jamnagar Municipal Corporation or the relevant Gram Panchayat, depending on their location. This process ensures that all operations meet local regulations, avoiding potential penalties or legal issues. If you need assistance with Professional Tax Registration in Jamnagar, our expert team is here to help. We provide prompt, efficient service to guide you through the process smoothly, ensuring compliance with all regulatory requirements. Contact us today to streamline your Professional Tax registration and keep your business legally compliant.

Professional Tax Registration: Who Needs It in Jamnagar?

Any business, company, organization, or self-employed professional engaged in commercial activities within Jamnagar District must first obtain Professional Tax Registration. Specifically, this registration process must be carried out through the Jamnagar Municipal Corporation or the relevant Gram Panchayat, depending on the exact location of the business within the district. Consequently, the requirement for Professional Tax Registration is extensive and applies to all types of business establishments, including, but not limited to, trading shops, showrooms, offices, warehouses, theaters, hospitals, associations, and operators. Additionally, it also encompasses professionals such as doctors and lawyers, various agencies, schools, colleges, and other entities engaged in commercial activities.

Therefore, securing this registration becomes crucial for ensuring compliance with local tax regulations and avoiding potential legal issues. By adhering to these requirements, businesses not only demonstrate their commitment to following local laws but also contribute to the smooth operation of their activities within Jamnagar. Moreover, this proactive approach helps maintain regulatory compliance and fosters trust and credibility with local authorities as well as within the community. Consequently, it ensures a more secure and respected presence in the local market.

Types of Professional Tax Registration and What’s Required

There are following types of Professional Tax Registration Certificate can be obtain in Jamnager

- PEC – Professional Enrollment Certificate: Every Company, Establishment, or Business, therefore, requires PEC (PT) Registration. Specifically, this registration is essential for complying with local regulations and, consequently, maintaining operational legitimacy. Moreover, by securing PEC (PT) Registration, businesses can ensure they meet all legal obligations efficiently. Furthermore, timely registration not only builds trust and credibility but also guarantees smooth business operations without any regulatory hurdles. Thus, it is crucial for every entity to prioritize obtaining the PEC (PT) Registration as soon as possible.

- PRC – Professional Registration Certificate: After you obtain PEC Registration, if your Company or Business has employees on payroll, then PRC Registration is required. Specifically, this step is crucial to ensure compliance with regulations. Consequently, securing PRC Registration guarantees that your business aligns with legal standards. Furthermore, it demonstrates your commitment to following proper protocols. Therefore, obtaining the PRC Registration promptly is essential to avoid any potential issues and ensure smooth business operations. Additionally, this process helps maintain organizational integrity while ensuring regulatory adherence at all levels.

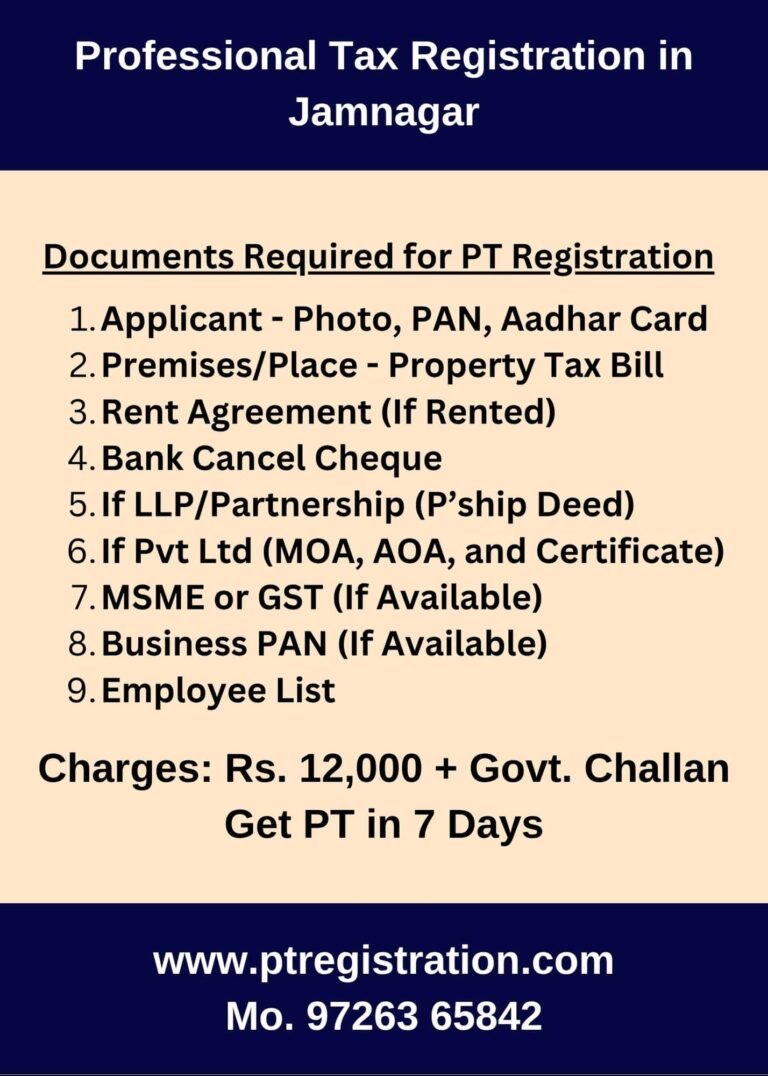

Doc's Required for Professional Tax Registration in Jamnagar

Following Documents Required for Professional Tax Registration Application in Jamnagar.

- Photo of Applicant

- PAN Card of Applicant

- Aadhar Card of Applicant

- Mobile and Email

- Premises/Place – Property Tax Bill of Jamnagar

- Rent Agreement (If Rented)

- Business Document (Any One – MSME, GST, Business PAN Card, Registration Certificate etc)

- If Partnership Firm (Partnership Deed)

- If Private Limited Company (MOA, AOA, and Certificate of Incorporation)

- Business PAN Card (If Available)

- Bank Cancel Cheque Photo (Company or Applicant)

- Employee List with Joining Date (Deployed in Jamnagar)

- Office/Shop Photo with Board

Professional Tax Registration Consultancy Package in Jamnagar

We are Best Consultant for Jamnagar Professional Tax Registration, Our Professional Fees are as

- Professional Fees: Rs. 12,000/- government challan extra as per rules.

- If Registration is Old Dated, Then Rs. 250 Per Month Since Beginning (Additional)

- Government Charges: Rs. 200/- Per Employee Per Month, AND Rs. 2400 Per Year for Company

- We Also Provide Shop Establishment Registration in Surat – Check Here

Professional Tax Consultancy Services in Jamnagar

- New Registration: New/Fresh Professional Tax Registration in Jamnager

- Change Request: Change in Address, Owner, Name, Particulars etc of Professional Tax

- Surrender or Cancellation of PT: Cancellation of Professional Tax Number in Jamnager

Government Tax Rates for Professional Tax in Jamnagar

- PEC:Employers (Companies) are required to pay Rs. 2400 per financial year for Professional Tax. Specifically, the exact amount payable will be influenced by various factors, including the business’s operational area within Jamnagar and the type of business activities conducted. Consequently, for businesses operating in different zones or engaged in diverse sectors, the PEC rates may be adjusted accordingly to align with regional tax policies and specific business requirements. Furthermore, these adjustments ensure that businesses comply with local tax regulations while also addressing the unique aspects of their operations. Therefore, it is essential to understand these nuances for accurate tax planning.

- PEC: For businesses in Jamnagar, there is a requirement to deduct Rs. 200 per employee per month as Professional Tax from their salaries. Specifically, this amount must be paid to the respective authority. However, if an employee’s salary is less than Rs. 12,000 per month, the Professional Tax is zero, meaning no deduction is required for such employees. Consequently, it is crucial to understand these thresholds to ensure proper tax handling.

Therefore, it is absolutely essential to accurately calculate and withhold the Professional Tax based on each employee’s monthly salary. Additionally, this practice ensures compliance with local tax regulations, preventing any issues related to underpayment. Moreover, it demonstrates your business’s commitment to regulatory adherence and keeps your operations running smoothly. Thus, by following these steps, you can avoid any potential penalties or complications.

Filing of PT Return (Payment of Professional Tax)

For businesses in Jamnagar, it is crucial to deposit the Professional Tax (PRC) and file Form 5-A (PT Return) within 15 days after the end of each month. The required amount is Rs. 200 per employee per month. This timely payment and filing ensure compliance with local tax regulations.

Additionally, adhering to this schedule helps avoid potential penalties or legal issues related to late submissions. Therefore, it is essential to manage these deadlines carefully and ensure that all necessary forms are completed accurately.

By maintaining punctuality in your Professional Tax obligations, you demonstrate your commitment to regulatory compliance and facilitate smooth business operations. For assistance with the payment process and filing requirements, consulting a professional can be beneficial to streamline the process and ensure all obligations are met efficiently.

Employers in Jamnagar are required to pay the Professional Tax Employer Certificate (PEC) before September 30th of each financial year. The amount ranges from Rs. 2000 to Rs. 5000, depending on specific business factors and location.

Timely payment of the PEC is crucial for complying with local regulations and avoiding any potential penalties or legal complications. Ensuring that this payment is made before the deadline helps maintain good standing with the authorities and supports smooth business operations throughout the year.

To streamline this process and ensure accurate payment, it may be beneficial to consult with a professional who can provide guidance and manage the necessary paperwork. By adhering to these requirements, you demonstrate your commitment to regulatory compliance and facilitate a more efficient business operation.

Do Multiple Jamnagar Offices Need Individual Professional Tax Registration?

In Jamnagar, the Professional Tax Registration system operates on a decentralized basis, which means that each branch or office of a business must secure its own separate Professional Tax Registration Certificate (PEC). Therefore, if your business operates multiple branches or offices within Jamnagar District or City, it is essential for each location to obtain its individual PEC. This requirement ensures that every branch complies with local tax regulations and adheres to the jurisdiction of the respective Municipal Corporation or Gram Panchayat.

Consequently, this decentralized approach guarantees that all business locations within Jamnagar are in full compliance with local tax laws, minimizing the risk of potential legal or financial issues. By securing separate registrations for each office or branch, you maintain proper documentation and regulatory adherence for every business site, which helps streamline administrative processes and supports smooth operations across all locations. This thorough compliance not only upholds your business’s legal obligations but also reinforces your commitment to operating within the regulatory framework set by local authorities.

Jamnagar Municipal Offices We Serve for PT Registration

Our Office : Jamnagar Field Officer for PT – Mr. Abhishek (Mo. +91 9726365842)

Jamnagar City – All Zones of Jamnagar City

Dhrol -Dhrol GIDC

Other Area and Village: All Area and Villages of Jamnager District – Kalavad, Dhrol, Lalpur, Jamjodhpur, etc.

Frequently Asked Questions on Professional Tax in Jamnagar

All businesses, companies, organizations, and self-employed professionals in Jamnagar engaged in commercial activities must pay Professional Tax. This obligation ensures compliance with local regulations and contributes to the fiscal responsibilities of operating within the district. By adhering to this requirement, entities demonstrate their commitment to meeting regulatory standards and support the administrative functions of local governance.

Register by applying to the Jamnagar Municipal Corporation or the local Gram Panchayat, depending on your specific business location. This process ensures that you comply with local regulations and fulfill your professional tax obligations. By choosing the appropriate authority based on your business’s location, you facilitate a smooth registration process and meet all necessary legal requirements.

Yes, each branch requires a separate Professional Tax Registration in the respective jurisdiction. This means that for every branch or office within Jamnagar District, you must obtain individual registrations from the relevant local authority. This ensures compliance with local regulations for each location and avoids potential issues with tax authorities. By securing the appropriate registrations for each branch, you streamline your administrative process and adhere to all legal requirements.

It is typically paid either annually or semi-annually, specifically following the local guidelines. Consequently, it is important to stay informed about these timelines to ensure compliance. Moreover, adhering to these payment schedules helps you avoid any potential penalties. Therefore, by following the guidelines carefully, you can streamline the payment process and maintain smooth operations.