Professional Tax Registration in Narmada

Are you in need of Professional Tax Registration in Narmada? If so, you’ve come to the right place! As local experts in PT Registration, we will guide you through the process and help you obtain your Company or Business Professional Tax Certificate (PRC and PEC) within just 7 days. According to the Surat Municipal Corporation (SMC) regulations, every business must secure Professional Tax Registration within 60 days of starting operations. Additionally, in Narmada, companies must pay Rs. 2400/- per year for Professional Tax. Meanwhile, each employee must contribute Rs. 200/- per month. Therefore, if you need Professional Tax assistance in Narmada, don’t hesitate to contact us for expert help!

Do you Need Professional Tax Consultant in Narmada?

Professional Tax Registration for Businesses in Narmada

In Narmada District, businesses must adhere to the Gujarat State Tax on Profession, Trades, Callings, and Employment Act, 1976. This law, therefore, requires all businesses, organizations, and trades to register under the Act and obtain a Professional Tax Registration (PEC) for their operations or branches in Narmada. Additionally, if your company employs staff, you must, consequently, secure a Professional Tax (PRC) Certificate.

You can efficiently complete the registration process through the Narmada Municipal Corporation or the local Gram Panchayat, depending on your location within the district. For example, the Narmada Municipal Corporation handles urban areas, while the Gram Panchayat manages rural locations.

If you need assistance with Professional Tax (PEC and PRC) Registration in Narmada, our team stands ready to provide prompt and efficient services. To ensure a smooth experience, contact us today for seamless registration support and expert guidance throughout the process!

Who Needs to Register for Professional Tax in Narmada?

Businesses, companies, organizations, and self-employed professionals conducting commercial activities within the Narmada District are required to obtain Professional Tax Registration. To begin with, this process can be completed through the Narmada Municipal Corporation or the relevant Gram Panchayat in your village.

Moreover, this requirement encompasses all types of business establishments. For instance, trading shops, showrooms, offices, warehouses, theaters, hospitals, associations, agencies, lawyers, schools, and colleges, among others, must adhere to this regulation.

Consequently, ensuring compliance with these regulations is crucial for maintaining smooth business operations in Narmada. Furthermore, adherence to this requirement not only helps avoid penalties but also ensures that your business contributes to local development. Thus, it is imperative to initiate the registration process promptly to align with local tax obligations.

Types of Professional Tax Registration and Their Requirements

In Narmada, you can obtain the following types of Professional Tax Registration Certificates:

- Professional Enrollment Certificate (PEC): Companies, establishments, or businesses must obtain this certificate to comply with local tax regulations. Securing a PEC is the crucial first step in the professional tax registration process.

- Professional Registration Certificate (PRC): After obtaining the PEC, businesses with employees must also acquire a PRC. This certificate is essential for fulfilling professional tax obligations for employees. It ensures compliance with tax requirements and helps maintain efficiency in meeting all aspects of professional tax obligations.

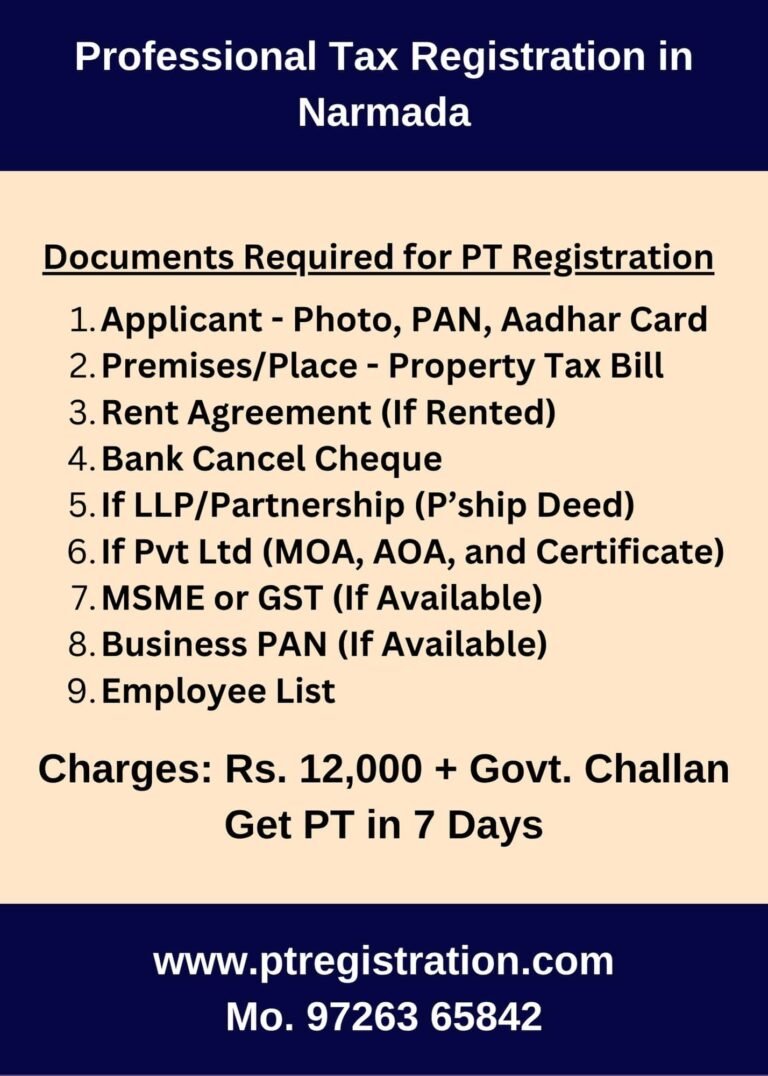

Required Documents for PT Registration in Narmada

The following documents are needed for applying for Professional Tax Registration in Narmada:

– Photo of Applicant

– PAN Card of Applicant

– Aadhar Card of Applicant

– Mobile and Email

– Premises/Place – Property Tax Bill of Narmada

– Rent Agreement (if rented)

– Business Document (any one – MSME, GST, Business PAN Card, Registration Certificate, etc.)

– If Partnership Firm (Partnership Deed)

– If Private Limited Company (MOA, AOA, and Certificate of Incorporation)

– Business PAN Card (if available)

– Bank Cancelled Cheque Photo (Company or Applicant)

– Employee List with Joining Date (deployed in Narmada)

– Office/Shop Photo with Board

These documents collectively ensure that the application for Professional Tax Registration is complete and meets all regulatory requirements.

Professional Tax Registration Consultancy Fees in Narmada

Leading Consultants for Professional Tax Registration in Narmada

Our consultancy fees for Professional Tax Registration are as follows:

- Professional Fees: Rs. 12,000/- government challan extra as per rules.

- Additional Fees for Old Registration: ₹250 per month from the start date

- Government Fees:

- ₹200 per employee per month

- ₹2,400 per year for the company

Furthermore, we offer additional services, including Shop Establishment Registration in Narmada. [Check Here]

By choosing our consultancy services, you ensure comprehensive support throughout the registration process.

Expert Tax Consulting Services in Narmada

New Registration: Starting a new venture? We make it incredibly easy to obtain Professional Tax Registration in Narmada. To begin with, our streamlined process ensures you can start your business with minimal hassle. Furthermore, we guide you through each step to make sure you meet all requirements smoothly.

Modification Requests: Need to update your details? We handle changes to your address, owner information, name, and more. Additionally, if any information needs adjustment, we provide prompt assistance to ensure your records remain accurate and current. Thus, you can maintain compliance without interruptions.

Surrender or Cancellation: Planning to close or discontinue? We assist with the termination of your Professional Tax Number in Narmada. Specifically, our team manages the entire process, ensuring that your professional tax obligations are properly concluded. As a result, you can focus on your next steps with peace of mind.

Whether you’re registering for the first time, updating information, or discontinuing, we provide comprehensive support every step of the way! Moreover, our dedicated team ensures a smooth and efficient experience, so you can concentrate on your business activities with confidence.

Current Government Professional Tax Rates in Narmada

PEC: Employers (Companies) are required to pay a Professional Tax of ₹2,400 annually per financial year. However, this amount can vary based on the business’s location and nature, ranging from ₹2,000 to ₹5,000 annually. Consequently, businesses must assess their specific circumstances to determine the exact amount payable.

PEC: For Employee Tax, ₹200 per employee per month must be deducted from their salary and remitted to the relevant authorities. Importantly, if an employee’s salary is below ₹12,000, no Professional Tax is applicable. Thus, employers need to carefully evaluate each employee’s salary to ensure accurate tax deductions.

These provisions, therefore, ensure adherence to Professional Tax regulations.

Professional Tax Return Submission

Deposit and File: First, deposit the Professional Tax (PT) payments. Additionally, file Form 5-A (PT Return) within 15 days after the end of each month. Ensure timely payment of Rs. 200 per employee per month.

Make PEC Payment: Moreover, employers are required to make their Professional Tax (PEC) payment by September 30th of each financial year. Consequently, the amount varies from Rs. 2000 to Rs. 5000, based on specific criteria.

Is Professional Tax Registration Required for Each Office/Branch in Narmada?

In Narmada, each branch or office requires its own Professional Tax Registration Certificate (PEC) due to the decentralized system. Therefore, if you operate multiple offices within the Narmada District or City, you must, consequently, register each location individually with the relevant Corporation or Village jurisdiction. This approach not only ensures compliance with local regulations but also, in turn, facilitates smooth operations across all your business locations. By adhering to these requirements, you effectively streamline the registration process and, ultimately, maintain operational efficiency throughout your business.

Municipal Corporation Offices in Narmada We Handle for PT Registration

Our Office : Narmada Field Officer for PT – Mr. Abhishek (Mo. +91 9726365842)

Narmada City – All Zones of Narmada City

Bharuch – GIDC Bharuch

Other Area and Vilalge: All Area and Villages of Narmada District – Bharuch, Dahej, Ankleshwar, Vapi, Jambusar etc.

FAQ's on Professional Tax in Narmada

Professional Tax is a state-level tax imposed on individuals and businesses for carrying out professions, trades, and employment. It varies by state; therefore, it is used to fund local infrastructure and services.

Individuals engaged in professions, trades, or employment, as well as businesses operating in Narmada, are required to pay Professional Tax. Specifically, this obligation includes salaried employees, freelancers, and business owners. Consequently, it is essential for all these individuals and entities to comply with the tax regulations.

Professional Tax is typically calculated based on the income or salary of the individual or the business. Each state, however, has its own slab rates and rules for calculation. Consequently, the tax amount may vary depending on the specific regulations in place. Therefore, it is important to be aware of and understand the applicable slab rates and rules in your state to ensure accurate calculation and compliance.

Yes, if you have multiple offices or branches in Narmada, then each location will likely need to obtain its own Professional Tax Registration Certificate (PEC) due to the decentralized system. Consequently, this ensures that each office complies with local tax regulations independently.