Professional Tax Registration in Patan

If you are seeking Professional Tax Registration in Patan, you’ve come to the right place! In fact, our team of local experts specializes specifically in Professional Tax Registration in Patan. Consequently, we ensure that you obtain your Company/Business Professional Tax Certificate (PRC and PEC) within just 7 days. Moreover, as per the Surat Municipal Corporation (SMC) rules, it is mandatory for every business to complete Professional Tax Registration in Patan within 60 days of starting operations. Specifically, in Patan, companies are required to pay Rs. 2400/- annually for Professional Tax, whereas each employee contributes Rs. 200/- per month. Therefore, for all your Professional Tax Registration needs in Patan, we encourage you to contact us for expert assistance without delay

Looking Professional Tax Expert in Patan?

Professional Tax (PT) for Occupation

In Patan District, The Gujarat State Tax on Profession, Trades, Callings, and Employment Act, 1976, governs Professional Tax rules. Accordingly, this Act requires every business, organization, or trade to compulsorily register under the Act and obtain Professional Tax Registration (PEC) for their business or branch in Patan. Furthermore, if a company employs individuals, it must obtain a Professional Tax (PRC) Certificate. In addition, you can obtain such registration from the Patan Municipal Corporation or the local Gram Panchayat, depending on your specific location within Patan District.

Therefore, if you need a Professional Tax Registration Consultant in Patan for PEC and PRC registration, please connect with our team. We will provide you with prompt and efficient service for Professional Tax Registration in Patan. Thus, we will ensure that you handle the registration process smoothly and comply with local regulations

Who Needs Professional Tax Consultant in Patan?

Any business, company, organization, or self-employed professional engaged in commercial activities within the geographic boundaries of Patan District is required to obtain Professional Tax Registration. Specifically, this registration must be secured from the Patan Municipal Corporation or the respective Gram Panchayat of the village in Patan District where the business operates. Consequently, every business establishment, including but not limited to trading shops, showrooms, offices, warehouses, theaters, hospitals, associations, operators, doctors, professionals, agencies, lawyers, schools, and colleges, is mandated to obtain Professional Tax Registration in Patan. Furthermore, this requirement ensures that all businesses adhere to local tax regulations and therefore contribute to the municipal revenue. In addition, securing Professional Tax Registration is essential for lawful operation and compliance in Patan. Thus, by following these regulations, businesses can maintain smooth operations and avoid any potential legal issues

Types of PT Consultant with Basic Requirement

There are following types of Professional Tax Registration Certificate can be obtain in Patan

- PEC – Professional Enrollment Certificate: Every Company/Establishment/Business Requires PEC (PT) Registration.

- PRC – Professional Registration Certificate: after PEC Registration if Company/Business have Employee in Payroll then PRC Registration Required to obtain.

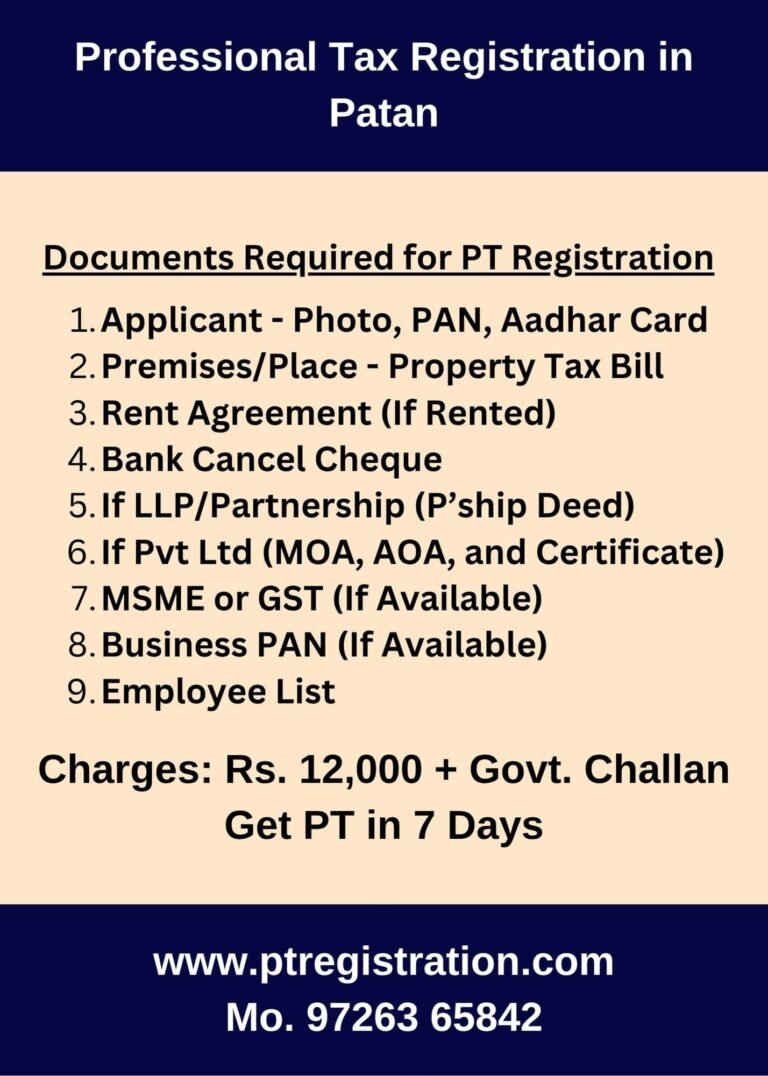

Doc's Required for Professional Tax Registration in Patan

Documents Required for Professional Tax Registration Application in Patan

– Applicant’s Photograph

– PAN Card of the Applicant

– Aadhar Card of the Applicant

– Contact Number and Email ID

– Property Tax Receipt for the Premises in Patan

– Lease Agreement (if the property is rented)

– Business Documentation (Choose one: MSME Certificate, GST Registration, Business PAN Card, Registration Certificate, etc.)

– Partnership Agreement (For Partnership Firms)

– Memorandum of Association (MOA), Articles of Association (AOA), and Incorporation Certificate (For Private Limited Companies)

– Business PAN Card (if applicable)

– Cancelled Cheque Image (Company or Applicant)

– Employee Roster with Joining Dates (for employees in Patan)

– Photograph of the Office/Shop with Signboard

Agency Fees for PT Registration in Patan

Our service fees for Professional Tax Registration in Patan are as follows:

- Professional Fees: Rs. 12,000/- government challan extra as per rules.

- If Registration is Old Dated: Rs. 250 per month since the beginning (Additional)

- Government Fees: Rs. 200/- per employee per month, and Rs. 2400 per year for the company

We also provide Shop Establishment Registration in Patan – Check Here.

Our Services as PT Agency in Patan

– Consultation Fees: Rs. 12,000/-

– For Backdated Registration: Rs. 250 per month from the start date (Additional)

– Government Fees: Rs. 200/- per employee per month, and Rs. 2400 per year for the company

Professional Tax Government Charges in Patan

- PEC: Employers (Companies) are, therefore, required to pay Rs. 2400 per financial year. However, depending on the specific location and the nature of the business, the PEC tax may, in fact, range from Rs. 2000 to Rs. 5000 annually.

- PEC: Additionally, when it comes to Employee Tax, Rs. 200 per employee per month must, indeed, be deducted from their salary and paid to the appropriate authority. Moreover, if the employee’s salary is below Rs. 12,000, then no Professional Tax is required.

Thus, these requirements ensure proper compliance with Professional Tax regulations.

How to File Professional Tax Returns and Make Payments

- Deposit and File: To begin with, you should deposit Professional Tax (PRC) payments and file Form 5-A (PT Return) within 15 days after the end of each month. Additionally, ensure timely payment of Rs. 200 per employee per month.

- Make PEC Payment: Employers must make their Professional Tax (PEC) payment before September 30th of each financial year. The amount typically ranges from Rs. 2000 to Rs. 5000, depending on various factors.

Who Need PT Registration for Each in Patan?

In Patan, due to the decentralized system, each branch or office must obtain its own separate PEC (Professional Tax Registration). For instance, if you have multiple offices in Patan District/City, it is crucial to register each location individually within the jurisdiction of the respective Corporation or Village. In this way, this ensures compliance and consequently facilitates smooth operations across all your business locations in the area. Moreover, by adhering to this process, you not only align with local regulations but also enhance operational efficiency therefore avoiding any potential issues. Thus, ensuring that every office is properly registered is fundamental for maintaining both legal compliance and seamless business operations

Municipal Corporation Offices in Patan

Our Office : Patan Field Officer for PT – Mr. Abhishek (Mo. +91 9726365842)

Patan City – All Zones of Patan City

Patan – Patan GIDC

Other Area and Village: All Area and Villages of Patan District – Siddhpur, Vijapur, Radhanpur, Kheralu, Santalpur, Chanasma, etc

FAQ's on Professional Tax in Patan

Professional Tax (PT) is a tax levied by the state government on professionals, trades, callings, and employment. It is mandatory for both businesses and individuals engaged in professions in Aravalli to pay this tax.

Yes, each branch or office in Patan must have its own separate PEC (Professional Tax Registration) to comply with the decentralized system.

Professional Tax (PEC) payment must be made before September 30th of each financial year. The amount varies from Rs. 2000 to Rs. 5000, depending on various factors.

In Patan, all businesses, employers, and professionals earning an income are required to pay Professional Tax. This includes individuals employed in various professions, as well as businesses operating within the jurisdiction.