Shop Establishment Registration in Patan

Are you looking to establish a shop in Patan? If so, we make the registration process effortless for you by not only managing everything with the Patan Municipal Corporation or Gram Panchayat, but also ensuring that every step is handled with utmost precision. Furthermore, our expertise guarantees that you will quickly obtain your Trade License or Shop Act License. In addition, our streamlined service promises completion within just five days, therefore making it incredibly simple and stress-free to start your business. Consequently, you can focus on what truly matters—growing your business. So, reach out to us today for fast and dependable support!

Looking for Expert Gumasta Registration Services in Patan?

Shop Registration Services in Patan

In Patan, all businesses, including shops and other types of establishments, must register with the local Patan Municipal Corporation or the Gram Panchayat of Patan District. Consequently, this registration process is governed by the Gujarat Shops and Establishments (Regulation of Employment and Conditions of Service) Act, 2019. Therefore, employers in Patan must adhere to the procedures outlined in this Act to ensure proper registration. By doing so, they align with legal requirements and avoid potential compliance issues. Moreover, this process helps in streamlining business operations and ensuring that all employment conditions are regulated as per the stipulated guidelines. In summary, proper registration is crucial for lawful operation and helps in maintaining smooth business practices in Patan.

- Registration: If a business employs 10 or more individuals, the employer must submit an application using Form-A to register under the Shop Act.

- Intimation: If a business employs fewer than 10 individuals, the employer must submit an intimation application using Form-D.

Submit these applications to the Patan Municipal Corporation along with the necessary documents and fees. Additionally, employers must maintain registers as stipulated by the Act and file an annual return each year. In Patan, the Shop Establishment Certificate is commonly referred to as a Gumasta License, Trade License, Shop Act License, or Gumastadhara. Furthermore, for any assistance with obtaining a Shop Establishment Certificate in Patan, please do not hesitate to contact us.

Who Is Required to Get a Shop Act License in Patan?

All businesses, companies, organizations, and self-employed individuals conducting commercial activities in Patan District must, therefore, obtain a Shop Establishment, Gumasta, or Trade License from the Patan Municipal Corporation (SMC) or the appropriate Gram Panchayat. This requirement is crucial because it applies to a wide range of establishments, including retail shops, showrooms, offices, warehouses, theaters, hospitals, associations, professional services such as doctors and lawyers, agencies, schools, and colleges. Consequently, securing Shop Establishment Registration is imperative for operating legally within Patan. By obtaining this license, businesses not only meet legal requirements but also facilitate smooth operations. Moreover, it helps avoid potential legal complications and demonstrates a commitment to regulatory standards. Consequently, this fosters trust within the community, ensuring long-term success and stability.

Essential Information on Shop Act Registration in Patan

Each state and city uses its own terminology for shop registration. Consequently, in Patan District, the following terms are commonly used for Shop Establishment Registration:

- Gumasta License in Patan

- Gumastadhara Registration in Patan

- Shop Establishment Certificate in Patan

- Trade License in Patan

- Shop Act License

- Namuna-4 (Form-4) – Business Registration (for Gram Panchayat)

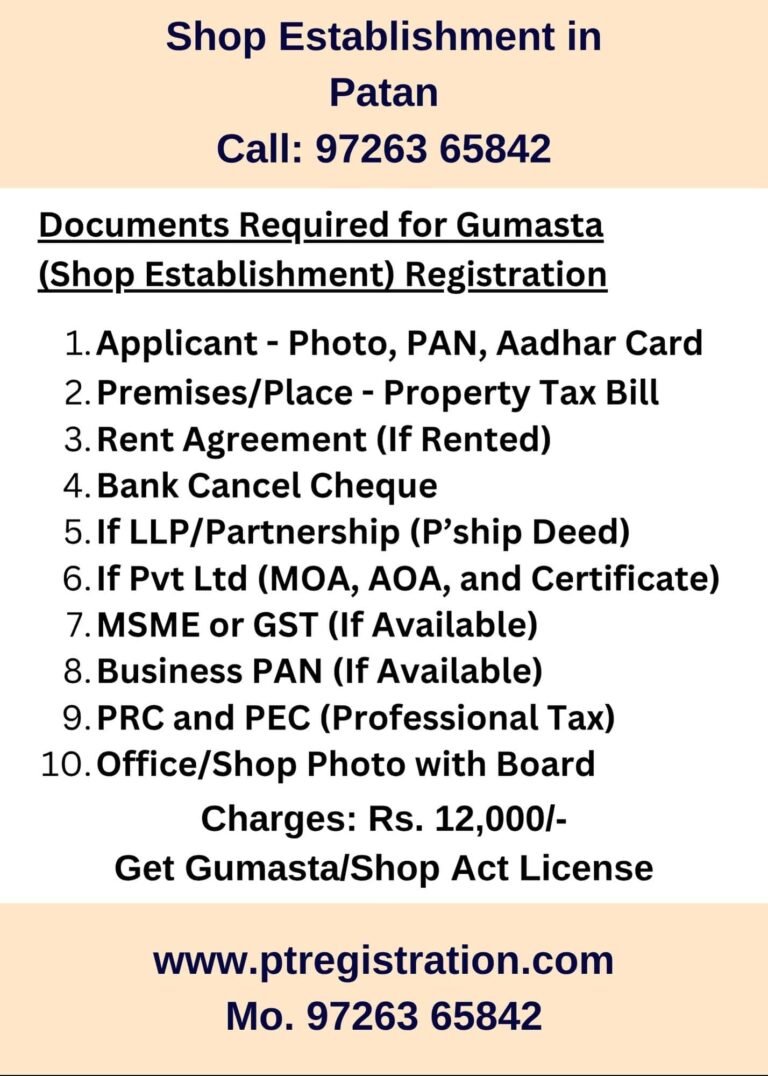

Documents Required for Shop Establishment Registration in Patan

To apply for a Shop Establishment or Gumasta Registration in Patan, the following documents are needed:

- Applicant’s Photograph

- PAN Card of the Applicant

- Aadhar Card of the Applicant

- Contact Information: Mobile Number and Email Address

- Property Tax Bill for the Premises in Patan

- Rent Agreement (if the premises are leased)

- Business Proof (Any one: MSME Certificate, GST Registration, Business PAN Card, Registration Certificate, etc.)

- Partnership Deed (for partnership firms)

- Memorandum of Association (MOA), Articles of Association (AOA), and Certificate of Incorporation (for Private Limited Companies)

- Business PAN Card (if available)

- Canceled Bank Cheque (for the company or applicant)

- Photograph of the Office or Shop with the Signboard Visible

- Professional Tax Registration in Patan (PRC and PEC)

Cost of Shop Establishment Registration in Patan

We are the top consultants for Trade Licenses and Shop Establishment Registration in Patan. Our service fees are outlined below:

- Professional Fees: Rs.12,000/-

- Government Charges (Additional):

- Rs. 500 – For Shops/ Office/ Establishment

- Rs. 2500/- For Hotels

- Rs. 1000/- For Eating & Restaurants

- Rs. 5000/- For Theater or Public Entertainment Places

(We also provide services for updating details such as address, name, or owner information for Shop Establishment Registrations. Additionally, we assist with business closures, including the surrender or cancellation of Shop Establishments.)

Patan Shop Registration Necessary Premises Conditions

Yes, you must obtain a Professional Tax Registration Certificate before you submit your Shop Establishment Registration Application. To achieve this, you should secure the PEC (Professional Employment Certificate) and/or PRC (Professional Registration Certificate) for business registration under the Shop Establishment Act. By completing these requirements, you ensure compliance with regulations, which will, in turn, facilitate a smoother registration process. Additionally, having all the necessary certificates and documents in hand allows you to proceed confidently with your Shop Establishment Registration. Thus, addressing these prerequisites efficiently will help you streamline your registration process and avoid potential delays or complications.

Furthermore, having the Professional Tax Registration Certificate and other required documents readily available not only speeds up the application process but also shows your commitment to adhering to legal standards. Therefore, you should prioritize obtaining these certificates early in the registration process. Doing so ensures that your application remains complete and aligns with all relevant regulations, ultimately contributing to a more seamless and efficient registration experience.

Gumasta/ Shop Establishment Act in Rural Patan How It Applies

The rules of the Shops and Establishments Act of Gujarat apply statewide, encompassing all cities and villages. However, in the rural areas of Patan District, businesses must, therefore, register with the local Panchayat. Consequently, businesses should obtain the Gumasta Registration from the Tehsildar (Talati) of the respective Village Gram Panchayat in Patan. Furthermore, this process ensures that businesses comply with local regulations and receive the necessary authorization. Additionally, obtaining the Gumasta Registration through the Village Gram Panchayat streamlines administrative procedures and helps businesses operate legally within the district. As a result, adherence to these local requirements facilitates smoother business operations and enhances regulatory compliance. In summary, by following these guidelines, businesses can ensure they are fully compliant with local regulations, leading to more efficient and legally sound operations.

Should I Register Each Branch Separately Under Shop Establishment in Patan?

In Patan, the registration process for Shop Establishment or Trade Licenses is decentralized, meaning each branch or office must independently secure its own license. Therefore, if you operate multiple offices within Patan District or City, each location must obtain individual registration from the appropriate authority, whether it is the Municipal Corporation or the Gram Panchayat of the respective area. Consequently, you need to submit the required documentation and fees separately for each office, ensuring compliance with local regulations. Hence, managing multiple registrations necessitates careful attention to detail and adherence to guidelines for each location. For assistance with this process, feel free to contact us.

Patan Shop Act Simplified Registration Process

Our Office Contact for Shop Establishment or Gumasta Registration in Patan:

Patan Field Officer: Mr. Abhishek

Mobile: +91 9726365842

Coverage Areas:

- Patan City: All Zones within Patan City

- Patan: Patan GIDC

- Other Areas and Villages in Patan District: Including Siddhpur, Radhanpur, Harij, Sami.

FAQ's on Shop Establishment in Patan

Shop Establishment Registration is a mandatory registration required for businesses, shops, and commercial establishments to legally operate within Patan. It ensures compliance with local labor laws and regulations.

Any individual or entity that opens a shop, commercial establishment, or business in Patan, including retail stores, offices, restaurants, and service providers, must apply for this registration.

You can apply for Shop Establishment Registration through the Patan Municipal Corporation or the respective Gram Panchayat by submitting the required documents and forms. The process can also be handled by professional consultants.